Upcoming events

Nothing Found

Events in retrospect

26-27.11.2025: Impact Festival

The Sustainable Finance Cluster contributed two key program elements as Content Partner of TechQuartier at Europe’s largest B2B event for sustainable innovation in Frankfurt. The event made one thing clear: Sustainable finance is far more than compliance – with the right balance of targeted regulation and innovative financing solutions, it becomes a driver for growth.

Former Federal Minister of Finance Dr. Jörg Kukies opened with a keynote on the current situation of sustainable finance in Germany. He emphasized that the Omnibus process can help protect small companies from excessive bureaucracy, while harmonization between CSRD rollback and the demands of ECB/EBA is necessary. In the subsequent panel, Petra Sandner (Helaba), Jürgen Kern (KfW), and Juergen von der Lehr (ING Deutschland) discussed central questions of transformation finance, moderated by Matthias Hübner. Their key message: Reliable data, structured customer engagement, and the strategic use of decarbonization as a competitive advantage are crucial for success.

In a practice-oriented masterclass, moderated by Dr. Lukas Figge-Muschalik, Sebastian Moser (DZ BANK) and Adrian Wons (Senken) shared their expertise on Voluntary Carbon Markets. For over 30 participants, they demonstrated how quality standards, carbon removals, and the central role of banks as risk managers are shaping the market.

We are looking forward to IMPACT FESTIVAL 2026 and further discussions on the future of sustainable financial markets!

24.11.2025: KfW´s Biodiversity Talks 2025

KfW hosted, together with the Sustainable Finance Cluster, VÖB, VfU, Global Nature Fund, and PwC Germany, this event for the German banking sector in Frankfurt. Over 100 experts came together to discuss concrete approaches for integrating biodiversity into banking processes. The event made one thing clear: Biodiversity is no longer a future topic – banks must act now, and they can.

Dr. Lukas Figge-Muschalik presented the Sustainable Finance Cluster’s 12-step Biodiversity Roadmap – a practical compass for strategy development and operational integration of biodiversity aspects. The roadmap provides banks with a structured path from strategic anchoring through data management to risk analysis and product integration.

In two breakout sessions, three key findings emerged: Biodiversity and land sealing must be made tangible and strategically prioritized. Pilot projects are essential to move from knowledge to action. Regulatory requirements remain a challenge but should not be used as an excuse.

Further inspiring contributions came from Katharina Lambsdorff, Patrick Weltin, Andrea Reuter, Dr. Miles Parker, Angela McClellan, Kristina Brennecke, Katja Kirchstein, Marianne Strunz, Nadine Henze, Dr. Sonja Stuchtey, Dr. Hubertus Pleister, and Caroline Barr.

The event demonstrated: The industry is ready for implementation – now it’s about taking concrete steps and creating positive examples.

1./2.10.25: 9th Sustainable Finance Summit

Under the motto “Sustainable Financing: Bridge between Financial and Real Economy,” approximately 500 experts came together to discuss the latest developments and challenges of Sustainable Finance and to develop concrete solutions for collaboration between companies and the financial industry.

“There is an increasing recognition that Sustainable Finance is an important factor in the international competition for talent, institutional settlements, and assets,” said Matthias Hübner, Managing Director of the Sustainable Finance Cluster. “We need the business cases for Sustainable Finance. This is neither about altruism nor bureaucracy, but about doing good while making money.”

The two-day conference focused on central themes such as regulation, transparency standards, biodiversity, transition plans, sustainable investments, construction financing, CO2 certificate trading, and the transformation of the ‘Mittelstand’. The event offered a broad program of presentations, panel discussions, and workshops.

The event emphasized the urgency of the topic in times of regulatory uncertainty, ESG backlash, and geopolitical turbulence. A central conclusion of the summit is: Keep calm and carry on!

04.09.2025: Finance x Industry: an alliance for transformation (with a focus on Real Estate and Construction)

The Sustainable Finance Cluster and 4impact invited attendees to a high-profile expert event titled “Finance meets Construction Industry” at the Circle Hub Offenbach on September 4.

The response was overwhelming: numerous participants from the construction industry, financial sector, and politics took advantage of the opportunity to exchange ideas. Among the discussants were also the mayors of Frankfurt and Offenbach as well as Daniel Imhäuser (Blasius Schuster AG) and Michael Reckhardt (WIBank).

The focus was on the question of how sustainable financing models can accelerate the transformation of the construction and real estate industry. The discussions made it clear that a particular spirit of optimism is palpable: between the construction industry and the financial world, there is a growing willingness to talk with each other rather than about each other and to take concrete steps together to reduce CO₂ emissions and implement circular economy practices.

“The construction industry is the central sector when it comes to reducing CO₂ emissions. Therefore, this was a perfect start for our event series. Circular economy also offers the great opportunity that sustainable construction doesn’t automatically have to become more expensive. Every investment here makes a contribution with passion,” emphasized the organizers.

10.06.25: STM 25 – From Sustainability Transformation Monitor to Transformation Finance

This event makes one thing clear: transformation is happening — but it needs political clarity, strong data practices, and finance–real economy cooperation to reach scale and speed.

Jakob Kunzlmann (Bertelsmann Stiftung) and Dr. Manuel Reppmann (University of Hamburg) presented the key findings of STM25, a survey capturing how companies in the real economy and financial sector are progressing in the socio-ecological transformation.

Oliver Mergens from VAUDE shared how sustainability can become a core business driver. Drawing on their experience as a climate-neutral and family-owned outdoor brand, he showed how circular design, credibility, and innovation go hand in hand with long-term competitiveness.

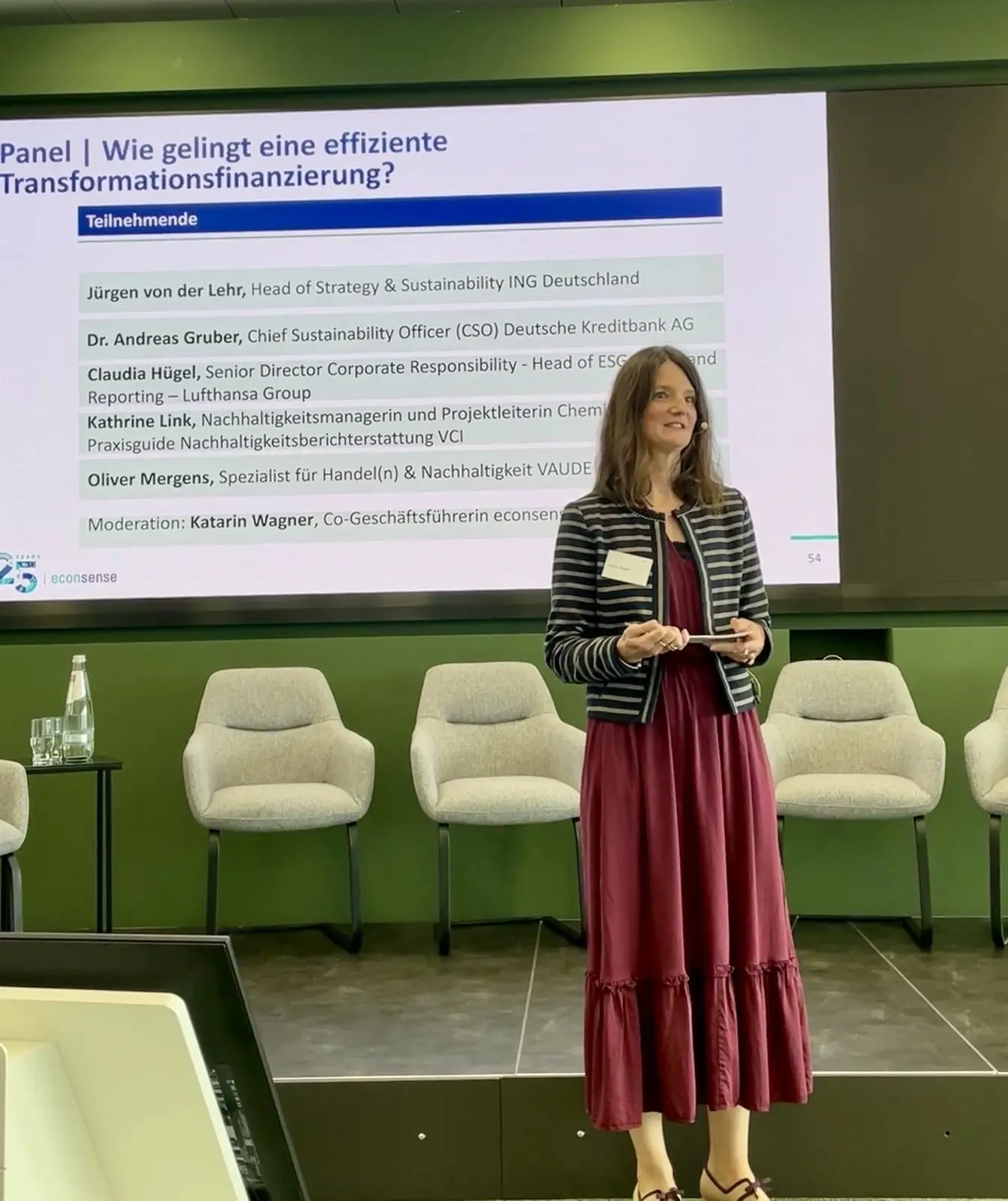

A distinguished panel, moderated by Katarin Wagner (Econsense) and featuring Juergen von der Lehr (ING), Andreas Gruber (DKB), Claudia Huegel (Lufthansa), Kathrine Link (VCI), and Oliver Mergens explored how efficient transformation finance can succeed in practice.

The Sustainable Finance Cluster co-hosted this event in partnership with econsense – Forum for Sustainable Development of German Business e.V. at ING Deutschland in Frankfurt.

19.5.25: Financial World in Europe

Food for thought and lots of insightful discussions and new contacts. Those were the ingredients of the “Finanzwelt in Europa” event, which the Sustainable Finance Cluster hosted together with Helaba, Wirtschafts- und Infrastrukturbank Hessen (WIBank) and the Hessian Ministry for Federal, European and International Affairs and Less Bureaucracy in Brussels.

A big thank you to Dr. Michael Reckhard (WIBank) for the warm welcome, Detlef Fechtner (Börsen-Zeitung) for being a great panel host as well as Markus Ferber, MdEP, Elena Arveras (European Commission) and our board member Petra Sandner (Helaba) for their interesting perspectives on the Omnibus initiative on sustainable finance regulation. Last but not least a shout-out to Jurica George Miketa and his team from WIBank for the excellent organization.

Thank you, Brussels. It was very insightful. We will be back for sure!

26.2.25: Cluster Get Together

At our Cluster Get Together, Sebastian Rink from Frankfurt School presented the most important findings from two recent working papers. One dealt with the question of how to estimate sustainability data from financial data with the help of machine learning (“It’s in the financials, stupid! But is it certain?”). The other paper dealt with the role of private capital in the context of the Paris climate goals (“Consistency or Transformation? Finance in Climate Agreements”).

A lively discussion developed with the participants on both topics. The exchange continued afterwards over snacks and drinks, then also with a view to the “big issues” such as the impact of the Bundestag elections on sustainable finance in Germany and the current proposal of the Omnibus Initiative.

22.1.25: Cluster annual kick-off

At our first get-together of the year at the Tech Quartier in Frankfurt, Heimo Saubach presented the key findings of the ESG Data Monitor 2024 conducted jointly by open ESG, PPA and Frankfurt School.

The current survey sheds light on the ongoing integration of ESG (environmental, social and governance) data into the risk management of financial institutions. Based on the survey of almost 150 financial institutions from Germany and Switzerland, the report provides valuable insights into the status quo, practical challenges and necessary solutions for the use of ESG data.

Following the presentation, the attendees discussed possible implications for the use of data in their organisations as well as remaining challenges. Many thanks to Heimo Saubach for the interesting presentation. We are looking forward to the new edition of the survey in 2025.

10./11.10.24: 8th Sustainable Finance Summit

The motto of the summit was “More impact, more change – sustainable finance in implementation”. Around 400 experts from the world of finance, business, research, politics and supervision came together to discuss the latest developments and challenges in the implementation of sustainable finance and to develop concrete solutions for practical implementation.

The summit, which took place for the 8th time annually, provides a platform for the exchange of expertise and experience on the design of a sustainable financial system. Particular attention was paid to the question of how financial players can implement the change towards greater sustainability in practice. It was discussed which targeted measures and innovations can be used to channel more financial flows into sustainable projects in order to accelerate ecological and social change.

Many of the speakers underlined the urgency of the topic and emphasized the importance of pragmatic cooperation between the real and financial economy. The conclusion of the summit is: the future of finance is sustainable – and the time to act is now!